All About Scj Cooper Realtors

Wiki Article

Scj Cooper Realtors Can Be Fun For Anyone

Table of ContentsAll About Scj Cooper RealtorsOur Scj Cooper Realtors IdeasA Biased View of Scj Cooper RealtorsWhat Does Scj Cooper Realtors Do?Top Guidelines Of Scj Cooper Realtors

You might additionally have a hard time to find sufficient tenants to load that workplace building or retail center you acquired. This is when you purchase a house for a lower rate, restore it swiftly and also after that market it for a fast revenue.You're not interested in monthly rental fees when flipping a residence. Rather, you require to acquire a residence for the cheapest feasible rate if you want to make a great profit when selling.

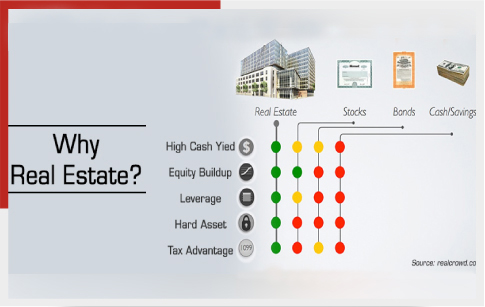

Diversifying your investment profile is essential. If you put all your eggs in one basket, you can suffer a total loss in the blink of an eye. scj cooper realtors. However when you spend some funds in the stock market, other funds in bonds or ETFs, and some in property, you enhance your opportunities of higher profits and fewer losses.

Neither is accurate, and also to guarantee you, below are 8 great reasons property is an excellent financial investment. The Top Reasons Genuine Estate Is an Excellent Investment If you're thinking of spending in property, you're about to start one of the most effective financial investment trips of your life time. scj cooper realtors.

Some Known Facts About Scj Cooper Realtors.

There aren't also several other financial investments that enable you to invest in possessions worth a lot more than you have to spend. If you have $10,000 to invest in the stock market, you can generally acquire just $10,000 worth of stock. The exemption is if you buy margin (borrow), yet you must be a recognized investor with a high total assets to make that happen.Let's say you discovered a home for $100,000; if you put down $10,000, opportunities are you could find a loan to finance the remainder as long as you have excellent credit scores as well as secure income. Keeping that, it indicates you invest just 10% of the property's worth and have it.

You won't obtain a dollar-for-dollar return on your investments, but some renovations can pay you back as long as 80% 90% of the cash invested. The restorations don't have to be major either. Of program, including a space or ending up the basement will add even more worth than basic aesthetic restorations, but also minor kitchen area and washroom remodellings can substantially influence a residence's well worth.

Excitement About Scj Cooper Realtors

When you invest in supplies or bonds, you can just write off any type of resources losses if you market the property for much less than you paid for it. They not only checklist readily available financial investment residences for sale, but numerous of them have lessees with leases in place already. Roofstock also offers plenty of Read More Here due persistance, investigating you, so all you have to do is acquire the residential property you assume is ideal (scj cooper realtors).

Without threat, there can't be a benefit. There's not much to feel protected regarding when you buy the marketplace. Yet, as 2020 revealed, it can alter in the blink of an eye. One min you have a significant investment, and also the following, you have actually shed every little thing. When you buy actual estate long-lasting, you recognize you have a valuing possession.

Scj Cooper Realtors - Questions

Many individuals spend in real estate to supplement their retired life income. Whether you possess the residential property while you're retired, earning the regular monthly rental cash flow to supplement your revenue, or you market a residential or commercial property you have actually owned for several years once you're in retired life as well as make an earnings, you'll enhance your retired life revenue.If getting property as well as leasing it out is as well difficult for you, there are lots of various other methods to buy property, including: Get an undervalued residential or commercial property, fix it up as well as turn it (fix as well as flip) Be a dealer working as the middle guy in between motivated sellers and also a network of customers.

Buy a Realty Investment Trust fund If you want to leave a heritage behind but don't think going money is a good idea, passing property down can be even better. Not just will you give your beneficiaries an income-producing asset, but it's likewise an appreciating property. So they can either maintain the building and allow the legacy proceed or sell it as well as gain profits.

For example, let's state you have $50,000 equity in a house. You can re-finance the home mortgage on it, take out the $50,000, and also utilize it as a deposit on your following property. Depending on the worth of your residential properties, you might even be able to pay cash for future properties, increasing your profile as well as the equity in it even faster.

Little Known Facts About Scj Cooper Realtors.

While there's not a one-size-fits-all response, there are specific credit look at this site to look for when you spend in realty, including: Seek a location that's appealing for renters helpful hints or with quick appreciating residences. See to it the area has all the amenities and also eases most home owners want Look at the location's criminal offense rate, institution scores, and tax background.Report this wiki page